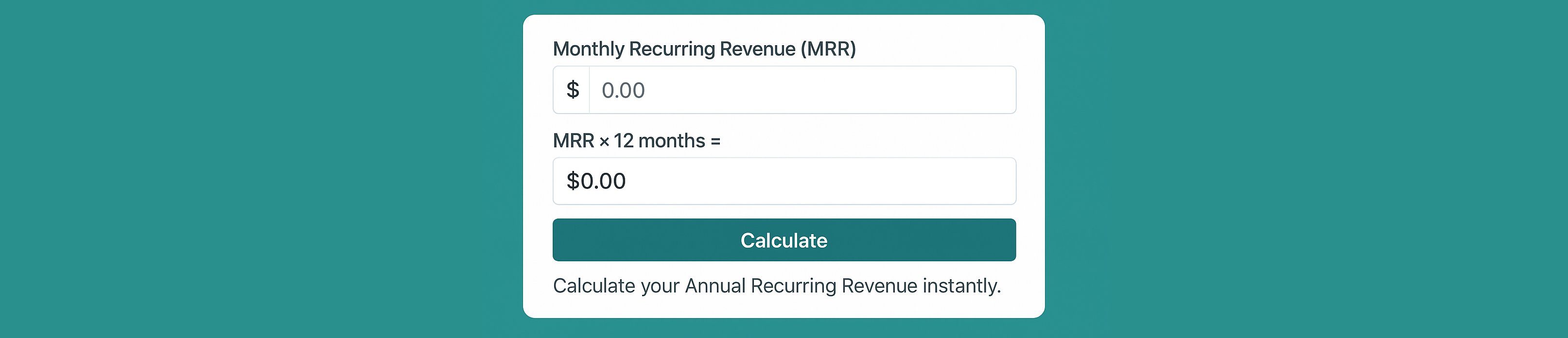

ARR Calculator

Calculate your Annual Recurring Revenue

If you’re running a subscription-based business or any service with steady monthly income, understanding your Annual Recurring Revenue (ARR) is essential. This free ARR calculator makes it easy to convert your monthly recurring revenue into one clear annual number.

Just enter your Monthly Recurring Revenue (MRR) in the box, making sure to include only subscriptions or contracts that renew regularly – not one-time sales. Then hit calculate and watch your ARR appear instantly.

The calculation is simple: it multiplies your MRR by 12. For example, $5,000 in MRR becomes $60,000 in ARR. This annual figure shows how healthy your business looks beyond month-to-month swings.

One mistake I’ve seen too often is mixing non-recurring payments like setup fees into the MRR input – that messes up the result and gives a false sense of growth. Also, avoid double-counting customers paying for multiple products; focus on unique recurring streams instead.

Using this free ARR calculator saves you from manual math or error-prone spreadsheets and delivers instant results without fancy financial tools – perfect whether you’re flying solo or managing a small team.

What Is Annual Recurring Revenue and Why It Matters

Annual Recurring Revenue, or ARR, shows the steady cash a business expects from customers over a year through subscriptions or contracts that keep renewing. When I first learned about ARR, it seemed like just another finance term, but soon I saw how vital it is for anyone running subscription-based businesses. It’s not about one-time sales; it’s all about the income flowing in month after month.

Knowing what Annual Recurring Revenue really means goes past crunching numbers – it reveals how stable your business actually is. Without this insight, you might chase growth moves that don’t match the real cash coming in. For me and many founders I’ve talked with, focusing on ARR cut distractions and kept us building lasting customer relationships instead of quick wins.

One mistake I often spot: mixing one-off payments like setup fees into ARR calculations. That muddies the picture because those earnings won’t return year after year. Also, remember ARR isn’t everything – it highlights recurring revenue but doesn’t cover churn or upsell chances.

ARR fits right in SaaS companies where monthly subscriptions dominate, but even traditional businesses with annual service contracts gain by tracking ARR to forecast better and invest smarter without relying on uneven sales bursts.

Annual Recurring Revenue Formula and Simple Calculation Steps

The Annual Recurring Revenue formula is simple but powerful: ARR equals your Monthly Recurring Revenue (MRR) times 12. This means you take the steady income from subscriptions or contracts each month and stretch it out over a full year to see the bigger picture.

MRR counts all recurring payments every month – excluding one-time fees or irregular charges. Multiplying by 12 projects this monthly figure into an annual number, showing how much reliable revenue you can expect.

For example, if your MRR is $3,500:

ARR = $3,500 × 12 = $42,000

This means you’ll earn $42,000 over a year from ongoing subscriptions.

Make sure your MRR includes only active subscriptions with regular billing cycles. Leave out setup fees or occasional upsells since they don’t repeat consistently. Also, keep an eye on customers paying for multiple services so you don’t count them twice.

Knowing your ARR provides solid ground for financial planning. It shows how much money flows in reliably and helps set growth goals without guesswork. When I started tracking ARR correctly, dealing with budgets became much easier because I had a clear sense of consistent income instead of depending on sporadic sales or one-offs.

ARR vs MRR Key Differences and When to Use Each

Monthly Recurring Revenue (MRR) is the predictable cash your business pulls in every month from subscriptions or contracts. Tracking MRR felt like having a pulse on my business – it showed how much money I’d actually see each month and helped me catch shifts fast, whether growth or churn.

The main difference between ARR and MRR comes down to time: MRR is monthly income, while ARR stretches that out over a year. ARR gives you a clearer picture of steady revenue, smoothing out those ups and downs you might spot with MRR’s month-to-month swings.

Entrepreneurs often use MRR for quick feedback – like checking if sales or marketing moves are working right now. It nails short-term trends better. But ARR works best when setting long-term goals, budgeting, or chatting with investors focused on yearly results.

From experience, early-stage businesses live by MRR because those first months feel huge – every win counts immediately. As things settle and grow, shifting focus to ARR keeps you locked onto sustainable revenue without getting sidetracked by seasonal changes.

For example:A startup pulling $10,000 in MRR means:$10,000 × 12 = $120,000 Annual Recurring Revenue.Seeing just the $10K monthly number doesn’t tell the full story of your annual foundation. That bigger figure smooths out monthly spikes into a solid snapshot of stability.

Which one you watch depends on where you’re at and what answers matter most – fast wins or slow-and-steady growth.

How to Calculate ARR for Complex Revenue Models

Annual Recurring Revenue seems simple to calculate when you’re dealing with flat-rate subscriptions. But once you add layers like multiple pricing plans, usage charges, or add-ons, things get messy fast.

I’ve seen founders struggle with how different subscription tiers vary in price and billing cycles, customers switching plans mid-term, cancellations that rock your revenue streams, and add-ons billed separately but still recurring. One-time fees thrown into the mix can also mess up the numbers if they’re not kept out of ARR.

Breaking down each customer’s contract makes a big difference. For upgrades and downgrades, prorating based on time spent on each plan during the year keeps your ARR realistic instead of inflating it with current snapshots alone.

Add-ons deserve their own spotlight since they’re mini-subscriptions themselves – you want to count just those charges that repeat regularly. One-time setup fees? They don’t belong here because they don’t provide ongoing value.

Discounts matter too. It’s best to factor them into monthly amounts before annualizing so your ARR reflects what actually lands in your pocket.

Fast-growth startups need reliable systems to update ARR whenever contracts change – new customers coming onboard at various tiers or existing users switching plans. Without staying sharp on these updates regularly, reported ARR drifts from reality and leads to bad calls around budgets or growth tactics.

Turning Customer Contracts Into Annual Recurring Revenue

When I started digging into my business contracts, it became clear how easy it is to mix up recurring revenue with one-time payments. The real key to unlocking dependable Annual Recurring Revenue comes from identifying what’s truly ongoing. Subscription fees, service renewals, and maintenance charges make up the steady income you want. Setup fees, training sessions, or hardware purchases usually happen once and don’t come back.

Getting contract data organized was a game changer for me. When payment terms are spelled out clearly – how often bills come in, coverage periods, renewal dates – I could actually forecast ARR without guessing. Instead of hunting through emails or messy spreadsheets, I pulled clean numbers that showed expected future income from each client.

Using tools like CRM systems and accounting software made tracking this info way easier over time. They flag upcoming renewals and warn about upgrades or cancellations that impact ARR immediately. From what I’ve seen, ручные updates quickly lead to outdated figures and surprise shortfalls when money doesn’t arrive as planned.

One big mistake companies often make is treating every contract value as recurring revenue without checking which parts repeat yearly versus charged just once upfront. Another slip-up happens when teams forget to adjust ARR after customers upgrade mid-contract or cancel early – that’s how reported annual revenue ends up looking far better than reality.

How Companies Use ARR in Real Life

Annual Recurring Revenue tells you more than just a number on a report – it acts like the heartbeat of your business. Companies lean on ARR to understand how steady their revenue streams are and make smarter decisions instead of guessing.

When startups pitch investors, ARR often grabs all the attention. It shows predictable yearly cash flow, giving backers confidence that the business isn’t chasing quick wins but building something lasting. Picture a SaaS company sharing a $1 million ARR during fundraising – it’s proof their subscriptions have real value and growth potential.

ARR also helps founders set clear goals. Running an app-based service with $200K in ARR? That number becomes your baseline for aiming at $300K next year by adding features or clients. Tracking how ARR changes over time offers a simple way to see if your plans are working or need change.

On the practical side, growing startups use current ARR to decide when it’s wise to hire another sales rep or open a new office. I know one founder who saw their ARR climb steadily every quarter and realized they could afford expanding their team without risking cash flow tightness.

Teams focused on customer success watch shifts in ARR closely since dips can warn about churn risks early – catching these let them jump in before subscribers slip away.

Getting annual recurring revenue right means making daily decisions backed by solid data rather than gut feelings alone. With this clarity, running your business feels less like guesswork and more like steering toward real targets.

Best Ways to Increase Annual Recurring Revenue

Boosting your ARR is about steady, smart moves that build lasting value over time – a mindset I’ve had to adopt as my business grew. Focusing on upselling and cross-selling to existing customers boosts revenue without the heavy lift of finding new clients. When you offer upgrades or complementary products, these offers land easier because trust is already there.

Keeping churn low plays a huge role too. Every customer who sticks around adds up over months and years; losing fewer subscribers means your base grows stronger without constant replacements. Churn often drops when you improve the customer experience – listening carefully when people cancel reveals what needs fixing before others leave.

Expanding into new markets where demand matches what you offer but competition is lighter opens doors for fresh subscriptions and recurring contracts without eating into current sources.

Listening closely to customer feedback has been key for spotting growth chances I would have missed otherwise. User pain points and wish lists spark ideas for adding features or services that keep customers happy while boosting what they pay each year – fueling ARR from within.

Committed Annual Recurring Revenue and Its Importance

Committed Annual Recurring Revenue (ARR) is the part of your recurring revenue that’s solid because customers signed contracts or made real commitments. Unlike forecasted ARR, which guesses on deals still in the pipeline, committed ARR sticks to what’s already confirmed – no guessing.

Revenue streams counting as committed have clear renewal terms, signed subscription agreements, or payment schedules customers promised. Deals not sealed yet or depending on future upsells don’t count here. For example, monthly fees from subscribers locked into a year-long plan are committed; pending proposals waiting for approval aren’t.

Tracking committed ARR gives you a reliable baseline for planning budgets and growth without surprises. When I started separating this from forecasts, I made moves like hiring or investing with actual confidence instead of hoping sales would close. Committed ARR anchors your business steady when other numbers swing wildly.

Keeping up with commitments means tracking contract dates and renewals carefully. Tools syncing with billing systems flag upcoming renewals and cancellations early so you see how much income is truly guaranteed each year. Without this clarity, it’s easy to overestimate revenue and scramble when some deals fall apart.

Focusing on committed ARR changed my view of business health: it cut wishful thinking and left dependable cash flow front and center. That shift brought better financial discipline and far fewer sleepless nights wondering if next month’s money will really show up.

Why ARR Is Essential for Subscription Business Success

Annual Recurring Revenue sits at the center of every SaaS and subscription business I’ve worked with. It’s not just a number on a report – it’s the clearest way to know how much steady income you can count on year after year. When I started paying serious attention to my ARR, it felt like opening new eyes that sharpened everything about running my business.

ARR shapes how I plan budgets and forecast growth because it cuts through one-time sales or unpredictable spikes. Knowing this figure means you’re no longer flying blind; you have a solid idea of what money will come in regularly. This clarity is key for deciding where to spend – whether hiring team members, upgrading tech, or boosting marketing.

What surprised me early was how tightly ARR ties into business valuation. Investors see your recurring revenue as proof your model works and sticks around. A higher ARR brings better credibility and stronger power when raising funds or selling shares.

Tracking ARR isn’t just about watching the cash flow – it guides product choices and marketing moves too. If your ARR rises after launching a feature or campaign, that’s clear feedback users dig what you’re offering. If it dips unexpectedly, it warns you to tweak things before small problems balloon.

Keeping an eye on Annual Recurring Revenue helped me spot trends long before they showed up elsewhere – whether those were solid growth phases or risks lurking under the surface. It became the compass leading many tough calls along my journey.

Leave a Reply